Unraveling the Layers of Business Protection: Exploring Workers Compensation, Business Insurance, and D&O Insurance

Welcome to the in-depth exploration of three essential layers of protection that every business should consider: Workers Compensation Insurance, Business Insurance, and D&O Insurance. As business owners, we constantly strive to safeguard our employees, assets, and interests from unforeseen risks. Understanding how these types of insurance function and the distinct benefits they offer is crucial in building a solid foundation for any business. Join us as we peel back the layers of protection, uncovering the importance and key aspects of Workers Compensation Insurance, Business Insurance, and D&O Insurance. So, let’s delve into these essential tools that can provide peace of mind while navigating the complex world of business.

Understanding Workers Compensation Insurance

Workers Compensation Insurance is an essential aspect of business protection. It provides coverage for employees who suffer work-related injuries or illnesses. This type of insurance ensures that injured workers receive compensation for medical expenses, lost wages, and rehabilitation services. Not only does workers compensation insurance safeguard the employees, but it also shields employers from potential lawsuits related to workplace injuries. It is a critical safety net that promotes a healthy and secure work environment for everyone involved.

In many jurisdictions, workers compensation insurance is mandatory for employers. By obtaining this insurance, businesses comply with legal obligations and demonstrate their commitment to the well-being of their workforce. In the unfortunate event of an accident or injury, workers compensation insurance ensures that employees are promptly taken care of, minimizing the financial burden they might face. Moreover, this coverage helps businesses maintain their reputation and employee morale by showcasing a strong commitment to their workers’ safety and overall welfare.

Workers compensation insurance policies vary depending on factors such as the nature of the business and the risks involved. Insurance providers consider various elements, including the industry, number of employees, and previous claim history when determining the coverage and premiums. It is crucial for businesses to understand the specifics of their workers compensation insurance policy, including the coverage limits, exclusions, and reporting procedures. By being well-informed, employers can make necessary adjustments to adequately protect their employees and mitigate potential risks.

Exploring Business Insurance

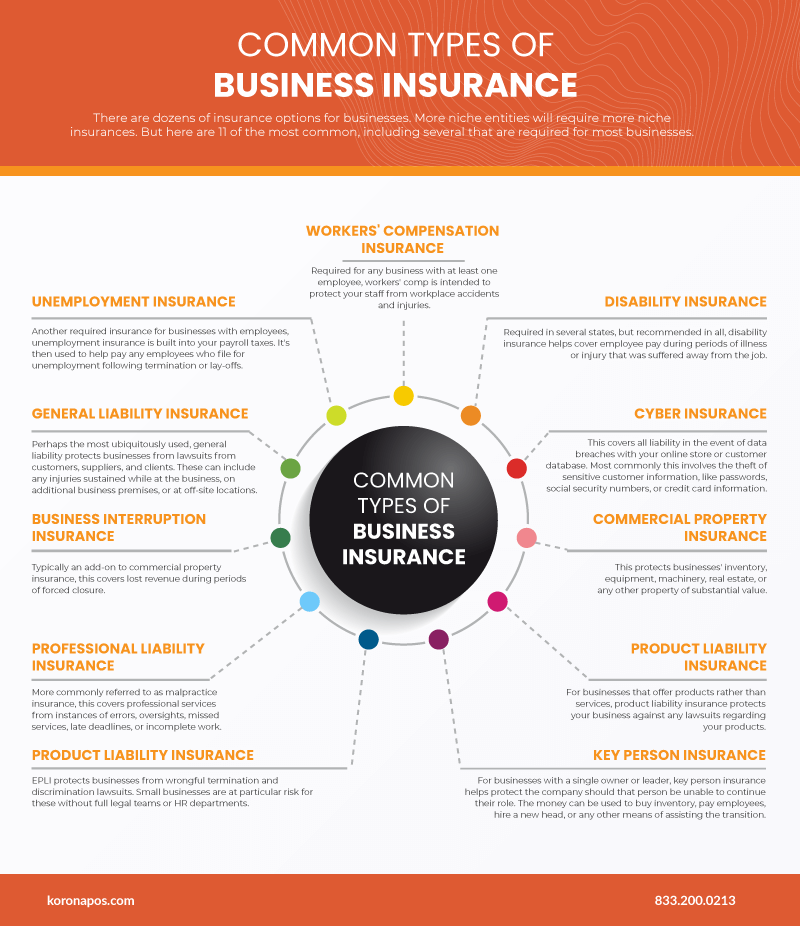

Business insurance is an essential component of any successful organization. It provides protection against unforeseen events and potential risks that could negatively impact the financial stability of a company. With the right insurance coverage, businesses can mitigate potential losses and have peace of mind knowing that they are protected.

One of the key types of business insurance is workers compensation insurance. This insurance coverage is designed to provide financial support to employees who suffer work-related injuries or illnesses. It helps cover medical expenses, lost wages, and rehabilitation costs, ensuring that employees are properly taken care of and enabling them to recover without facing financial burdens. Workers compensation insurance not only benefits employees but also protects employers from potential lawsuits related to workplace injuries.

In addition to workers compensation insurance, businesses also need to consider general business insurance. This type of insurance provides coverage for a wide range of risks, including property damage, theft, liability claims, and legal expenses. Whether it’s damage to physical assets, such as buildings or equipment, or liability issues arising from product defects or accidents on business premises, general business insurance offers valuable protection and ensures that businesses can recover quickly from unexpected events.

Furthermore, directors and officers (D&O) insurance is another crucial aspect of business insurance. This type of coverage is specifically designed to protect executives and board members from personal financial losses resulting from legal actions brought against them in their capacity as company leaders. D&O insurance provides coverage for defense costs and settlements in cases involving allegations of mismanagement, breach of fiduciary duty, or other wrongful acts. This insurance not only safeguards the personal assets of directors and officers but also helps attract and retain top talent by offering additional protection to those in leadership positions.

With workers compensation insurance, general business insurance, and D&O insurance, businesses can create a comprehensive safety net that addresses a wide range of risks. By understanding the different layers of business protection and the specific types of insurance available, organizations can ensure the long-term stability and success of their operations.

Diving into D&O Insurance

Directors and Officers (D&O) Insurance is an essential layer of protection for businesses and their leadership teams. This type of insurance provides coverage for directors and officers in the event that they are held personally liable for their actions or decisions while serving in their respective roles. D&O Insurance is designed to safeguard these individuals and their personal assets, offering financial protection and peace of mind in an increasingly litigious business landscape.

Insurance For Hotels

One of the key benefits of D&O Insurance is that it extends coverage beyond the traditional scope of a company’s general liability insurance. While general liability insurance focuses on protecting the organization as a whole, D&O Insurance specifically caters to the unique needs of directors and officers. This coverage is especially crucial in today’s complex business world, where directors and officers face a wide range of potential risks and liabilities.

D&O Insurance typically covers legal defense costs, settlements, and judgments arising from claims related to various types of alleged wrongdoing or negligence. These can include breaches of fiduciary duties, mismanagement of company funds, or even allegations of wrongful termination. By providing financial assistance to directors and officers in facing these challenges, D&O Insurance serves as a valuable safety net and encourages responsible leadership within businesses.

In summary, D&O Insurance is a specialized form of coverage that addresses the unique risks faced by directors and officers. It offers financial protection for individuals who hold these positions within a company, shielding them from potential personal liability. By ensuring that directors and officers are adequately protected, D&O Insurance promotes good governance and helps businesses navigate the ever-changing legal landscape.