Unlocking the Potential of Microcaptives: A Guide to Thriving in the Captive Insurance Landscape

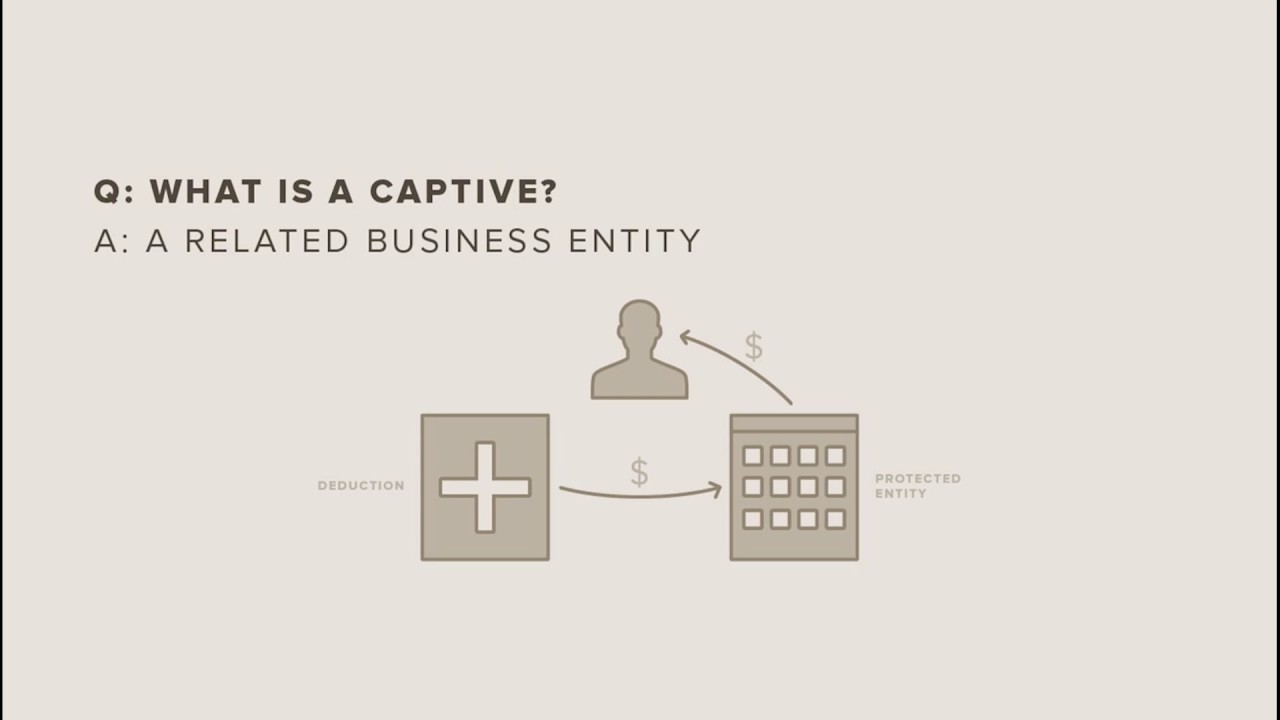

Microcaptives have been gaining significant attention in recent years for their ability to provide small and mid-sized businesses with greater control over their insurance needs. As a form of captive insurance, microcaptives offer an alternative to traditional commercial insurance policies, allowing businesses to create their own in-house insurance companies. This article aims to demystify the world of microcaptives and provide a comprehensive guide on how businesses can take advantage of this innovative insurance solution.

At the heart of microcaptives lies the 831(b) tax code, introduced by the Internal Revenue Service (IRS) to encourage small insurance companies. Captive insurance involves a company forming its own insurance subsidiary to meet its risk management needs, while microcaptives specifically refer to those entities that meet certain criteria stipulated under section 831(b). These captives have a unique advantage of being able to elect for tax exemption on their underwriting income, provided it falls below the designated threshold. This favorable tax treatment can lead to significant cost savings for businesses and serve as a catalyst for their growth.

Captive Insurance

Understanding how to navigate the intricate landscape of microcaptives can be daunting for those unfamiliar with the concept. However, it is crucial to recognize the potential benefits they offer. By establishing a microcaptive, businesses gain greater control over their insurance programs, allowing for customization and coverage tailored specifically to their unique needs. With firsthand knowledge of their risks and exposures, companies can implement risk management strategies that align precisely with their objectives, fostering a sense of empowerment and security.

In the following sections of this article, we will delve deeper into the intricacies of microcaptives, exploring how they operate, their advantages, and the compliance requirements set by the IRS. By unlocking the potential of microcaptives, businesses of all sizes can harness the power of self-insurance, ensuring comprehensive coverage, increased financial stability, and ultimately, the ability to thrive in an ever-evolving insurance landscape.

Understanding Microcaptives

Microcaptives, also known as 831(b) captives, are a type of captive insurance arrangement that has gained increasing popularity in recent years. These entities are formed by small to mid-sized businesses to self-insure certain risks and achieve tax advantages under the IRS 831(b) tax code.

At its core, a microcaptive operates like a traditional captive insurance company. It provides coverage for specific risks faced by the insured business, such as property damage, liability claims, or professional errors. However, what sets microcaptives apart is their eligibility to take advantage of the favorable tax treatment outlined in section 831(b) of the Internal Revenue Code.

Under this tax code, microcaptives meeting certain criteria can elect to be taxed only on their investment income and not on their underwriting profits. For businesses with annual written premiums below the $2.3 million threshold, this tax exemption can lead to significant tax savings and improved cash flow.

To qualify as an eligible microcaptive, an entity must meet specific requirements imposed by the IRS. These include having adequate risk distribution, conducting legitimate insurance activities, and properly documenting the insurance transactions. By satisfying these conditions, businesses can unlock the potential benefits of operating their captive insurance company under the 831(b) tax code.

In summary, microcaptives offer small to mid-sized businesses an attractive opportunity to enhance their risk management strategies and optimize their tax positions. Understanding the intricacies of microcaptives, including the IRS 831(b) tax code, is crucial for businesses seeking to thrive in the captive insurance landscape and maximize the advantages offered by these unique insurance arrangements.

The Benefits of 831(b) Captive Insurance

In the world of captive insurance, the 831(b) designation holds significant opportunities for businesses seeking to enhance their risk management strategies. Under the IRS 831(b) tax code, microcaptives are subject to certain favorable tax treatment, making them an attractive option for many companies.

One key advantage of utilizing a microcaptive is the ability to customize insurance coverage to fit specific business needs. Unlike traditional insurance policies, which often come with standardized terms and conditions, microcaptives can be tailored to align perfectly with the risks faced by a particular organization. This flexibility empowers businesses to have more control over their insurance programs, ensuring that coverage is maximized where it matters most.

Additionally, the 831(b) tax code offers potential tax benefits for businesses operating microcaptives. If structured and managed appropriately, a microcaptive can enjoy certain tax advantages, including the ability to receive tax-deductible premiums and accumulate income on a tax-deferred basis. This favorable tax treatment can not only lead to potential cost savings for businesses but also provide an avenue for building reserves to strengthen their overall risk management capabilities.

Furthermore, microcaptives can provide businesses with stability and continuity in times of market fluctuations or limited availability of insurance coverage. By establishing their own captive insurance company, businesses can create a reliable source of coverage that is not dependent on the traditional insurance market. This allows companies to have more control over their insurance program and ensure the availability of coverage tailored to their unique risks, regardless of market conditions.

In conclusion, the benefits of 831(b) captive insurance are numerous and can significantly contribute to a company’s risk management success. From tailored coverage and potential tax advantages to increased stability and control, microcaptives offer businesses a powerful tool for thriving in the captive insurance landscape.

Navigating the IRS 831(b) Tax Code

When it comes to navigating the IRS 831(b) tax code, understanding the intricacies and requirements is crucial. This tax code specifically pertains to microcaptives, which are small captive insurance companies that can provide numerous benefits for businesses. However, it’s important to follow the guidelines of the IRS to ensure compliance and avoid any potential issues.

One key aspect of the tax code is that the microcaptive must qualify as an insurance company for federal income tax purposes. This means that it must meet certain criteria, such as issuing insurance policies to its owners, being subject to regulatory supervision, and being structured as a bona fide insurance company. By meeting these requirements, the microcaptive can take advantage of the tax benefits provided under the 831(b) tax code.

Another important consideration is the annual premium limitation under the tax code. For a microcaptive to qualify, the maximum amount of annual written premiums cannot exceed $2.3 million. Going beyond this limit can result in the microcaptive losing its tax advantages and being subject to taxes as a traditional C corporation. It’s crucial to carefully manage and monitor the premium amounts to ensure compliance with this limitation.

Additionally, it’s important to stay updated on any changes or updates to the IRS 831(b) tax code. As with any tax regulations, the IRS may make revisions that impact how microcaptives are treated under the code. Staying informed through professional advice and regular monitoring of any IRS announcements will help businesses remain compliant and make the most of the potential benefits offered by microcaptives.

By understanding and navigating the IRS 831(b) tax code, businesses can unlock the full potential of microcaptives and thrive in the captive insurance landscape. Following the guidelines, meeting the qualifications, and staying informed are essential steps to ensure compliance and make the most of the tax advantages offered under this code.