The Ultimate Guide to Navigating Car Insurance: Unraveling the Confusion

Are you looking to demystify the complexities of car insurance? Look no further! In this ultimate guide, we will unravel the confusion surrounding car insurance, providing you with all the information you need to navigate this essential aspect of protecting your vehicle and your finances. Whether you’re a new driver or simply looking to gain a better understanding of your policy, our comprehensive guide will walk you through the ins and outs of car insurance, helping you make informed decisions and secure the coverage that suits your needs. From understanding the difference between homeowners insurance and car insurance to exploring the various types of auto insurance available, we’ve got you covered. So, let’s dive in and unravel the mysteries of car insurance together!

Understanding Homeowners Insurance

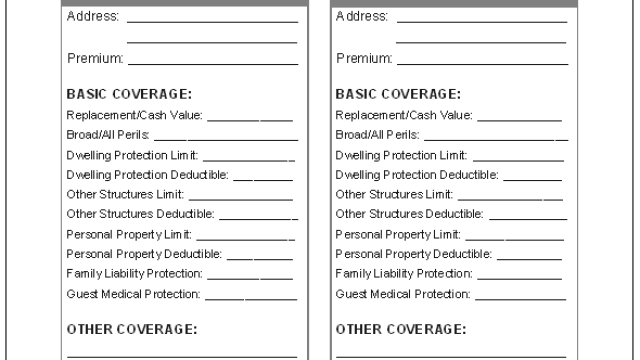

Homeowners insurance offers essential protection for your property and personal belongings. It provides coverage for damages caused by unforeseen events like theft, fire, or natural disasters. In addition to safeguarding your home and possessions, homeowners insurance also offers liability protection in case someone gets injured on your property.

The primary purpose of homeowners insurance is to provide financial security and peace of mind. Having this coverage ensures that if the unexpected occurs, you won’t have to bear the entire cost on your own. It gives you the confidence to face any potential damages or losses, knowing that you’re protected by a policy tailored to your specific needs.

Car Insurance Grand Rapids

When purchasing homeowners insurance, it’s crucial to carefully review and understand the terms and conditions. Policies may vary, so it’s important to know what is covered and what is not. Take the time to assess your property’s value and estimate the value of your belongings accurately. This will help you select the appropriate coverage that adequately protects your home and personal property.

Remember, homeowners insurance and car insurance are separate policies offering distinct types of coverage. While homeowners insurance focuses on protecting your property and belongings, auto insurance specifically covers damages related to your vehicle. Understanding the differences between the two can help you navigate insurance decisions more effectively.

Decoding Car Insurance

Car insurance can sometimes feel like a maze of confusing terms and jargon. Understanding the key concepts can help you make informed decisions about your coverage. In this section, we will decode the language of car insurance to simplify the process for you.

First, let’s talk about homeowners insurance. While it may seem unrelated to car insurance, these two types of insurance are often bundled together by insurance carriers. Homeowners insurance provides coverage for your home and its contents, protecting against damage or loss caused by unforeseen events such as theft or natural disasters. However, it’s important to note that homeowners insurance typically doesn’t cover damages or accidents related to your car. That’s where car insurance comes into play.

Car insurance, also known as auto insurance, is specifically designed to provide financial protection in the event of accidents, theft, or damage to your vehicle. It can also cover medical expenses for injuries sustained during a car accident. Car insurance policies vary in coverage levels and types, such as liability coverage, collision coverage, and comprehensive coverage. Liability coverage helps pay for damages you might cause to others, while collision coverage helps cover damages to your own vehicle caused by a collision with another car or object. Comprehensive coverage, on the other hand, protects against non-collision-related incidents, such as theft, vandalism, or natural disasters.

Understanding the basics of car insurance is essential for navigating the world of coverage options. By knowing the distinction between homeowners insurance and car insurance and becoming familiar with the different types of coverage available, you’ll be better equipped to make informed decisions when it comes to protecting yourself and your vehicle.

Navigating Auto Insurance

When it comes to navigating auto insurance, understanding the different types of coverage is key. There are various factors to consider when choosing the right policy for your needs. From liability coverage to comprehensive and collision coverage, each type offers different levels of protection.

One aspect to keep in mind is that car insurance is separate from homeowners insurance. While homeowners insurance provides coverage for your property, auto insurance specifically addresses the risks associated with owning and operating a vehicle. Therefore, it’s important to have a dedicated auto insurance policy to ensure you are adequately protected on the road.

With auto insurance, liability coverage is typically the minimum required by law. This coverage pays for injuries and damages caused to others in an accident where you are at fault. However, it’s often recommended to consider additional coverage options such as comprehensive and collision coverage to safeguard your own vehicle from various perils.

Comprehensive coverage protects your car against non-collision incidents, such as theft, vandalism, or natural disasters. On the other hand, collision coverage kicks in when your vehicle is involved in a collision with another vehicle or object. Having these types of coverage can bring peace of mind and financial protection in case of unexpected events on the road.

Remember, when navigating auto insurance, it’s crucial to assess your specific needs and consider factors such as your vehicle’s value, your budget, and your level of risk tolerance. By understanding the different coverage options available, you can make informed decisions and ensure you have the right level of protection for your car.