Shielding Your Business: The Essentials of Business Insurance

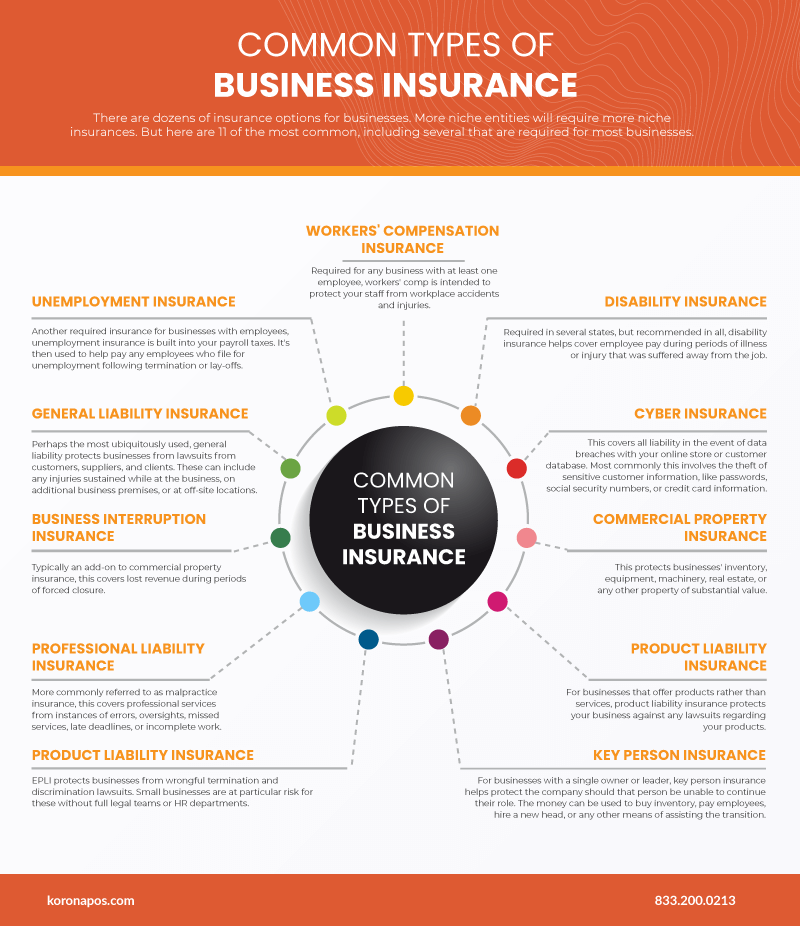

As a business owner, protecting your company is of utmost importance in today’s ever-changing landscape. With unforeseen incidents, accidents, and liabilities always lurking around the corner, having the right business insurance in place is crucial for the longevity and success of your enterprise. This comprehensive shield not only safeguards your assets but also provides a safety net that ensures the smooth operation and continued growth of your business. Among the various types of business insurance available, two key policies that deserve your attention are Workers Compensation Insurance and Directors and Officers (D&O) Insurance.

Workers Compensation Insurance is designed to protect both your employees and your company in the event of work-related accidents or injuries. This policy not only ensures that injured employees are provided with medical care and compensation for lost wages, but it also shields your business from potential legal disputes. By providing coverage for medical expenses, disability benefits, and rehabilitation costs, Workers Compensation Insurance not only helps your employees recover swiftly but also demonstrates your commitment towards their well-being and safety.

On the other hand, Directors and Officers (D&O) Insurance is specifically crafted to protect the key decision-makers within your organization. As a business owner, you know that making strategic choices and leading your company comes with inherent risks. D&O Insurance provides coverage against claims of mismanagement, negligence, or wrongful acts by directors and officers. Whether it is an allegation of financial misconduct, breach of fiduciary duty, or employment-related lawsuit, this policy safeguards the personal assets of your executive team and shields your company from costly legal battles.

In conclusion, business insurance serves as a vital shield that protects your business from unforeseen circumstances, potential legal battles, and financial implications. While Workers Compensation Insurance offers coverage and support to your employees in the face of work-related accidents, D&O Insurance shields your key decision-makers from personal liability in their leadership roles. By investing in the right business insurance policies, you can shield your company from risks, secure its future, and enjoy the peace of mind that comes with knowing you have proactively mitigated potential threats.

1. Workers Compensation Insurance

Workers Compensation Insurance is a crucial aspect of business insurance that provides financial protection for both employers and employees. This type of insurance is designed to cover medical expenses, lost wages, and rehabilitation costs in the event that an employee sustains an injury or becomes ill on the job.

By having Workers Compensation Insurance, employers can ensure that their employees are adequately protected and receive the necessary medical attention and financial support in times of need. Moreover, this insurance also protects employers from potential lawsuits that could arise from workplace accidents or injuries.

General liability insurance kansas

Worker’s Compensation Insurance is typically mandatory in most jurisdictions, and failing to provide this coverage could result in legal consequences for businesses. It not only supports injured workers but also plays a crucial role in maintaining a safe and secure work environment.

In conclusion, Workers Compensation Insurance is an essential component of business insurance that safeguards the well-being of employees while providing legal protection to employers. By acquiring this insurance, businesses can effectively shield themselves from potential financial and legal risks associated with workplace injuries or illnesses.

2. Business Insurance

Business insurance is crucial for safeguarding your company and its assets. It provides protection against financial losses in various areas. Two important types of business insurance include workers compensation insurance and directors and officers (D&O) insurance.

Workers compensation insurance is essential for any business with employees. It covers medical expenses and lost wages for employees who are injured or become ill on the job. By having this insurance in place, you can ensure that your employees receive the necessary support in case of work-related accidents or illnesses.

D&O insurance, on the other hand, is designed to protect the directors and officers of a company against claims alleging wrongful acts or decisions. It provides coverage for legal fees, settlements, and damages resulting from lawsuits brought against company executives. D&O insurance gives these key individuals the confidence to make critical decisions without the constant fear of personal liability.

By understanding the importance of business insurance and the specific types available, you can shield your business from potential financial risks and liabilities. It is crucial to assess your company’s insurance needs and consult with an insurance professional to determine the coverage that best suits your business requirements.

3. D&O Insurance

In addition to Workers Compensation Insurance and other forms of business insurance, Directors and Officers (D&O) Insurance is another crucial aspect of protecting your business. D&O Insurance specifically covers the personal liability of directors and officers in the event of claims related to their decisions and actions while serving in their respective roles.

D&O Insurance provides financial protection for directors and officers against lawsuits and legal expenses that could arise from allegations of negligence, errors or omissions, breach of duty, or wrongful acts. This type of insurance safeguards both the personal assets of directors and officers, as well as the overall financial stability of the organization itself.

One key advantage of D&O Insurance is that it can help attract and retain talented individuals for leadership positions within your business. Knowing they have personal liability protection in place can give directors and officers the confidence to carry out their duties effectively and make decisions that benefit the company.

In summary, D&O Insurance is an essential component of business insurance that shields directors and officers from personal liability associated with their roles. This coverage not only protects individual assets but also promotes a stronger business environment by offering reassurance to those in leadership positions.