Picture this scenario: your dream of owning a successful business in California has finally become a reality. The excitement of building something from scratch, serving customers, and generating profits is palpable. However, amidst the thrill and challenges of entrepreneurship, it is crucial not to overlook the importance of safeguarding your business with commercial insurance. Commercial insurance serves as a safety net, providing you and your business with peace of mind as you navigate the unpredictability of the business world. Whether you own a restaurant or rely on commercial vehicles, having comprehensive coverage is essential. In this article, we will demystify commercial insurance, specifically focusing on restaurant and commercial auto insurance in California. By the end, you’ll have a better understanding of how to protect your business, ensuring its longevity and success in an ever-changing environment. So, let’s dive in and explore the ins and outs of commercial insurance – a vital tool for any business owner in the Golden State.

Understanding Commercial Insurance

Commercial insurance in California is a vital safeguard for businesses of all sizes. It provides protection and peace of mind against unexpected events that could potentially disrupt or even bankrupt a company. Understanding the intricacies of commercial insurance is crucial for business owners to make informed decisions, ensuring they have the right coverage to meet their specific needs.

When it comes to commercial insurance for restaurants in California, it’s important to have a comprehensive understanding of the unique risks and challenges that this specific industry faces. From property damage due to fire or natural disasters to liability claims arising from slip-and-fall accidents or foodborne illnesses, restaurant owners must carefully assess their insurance needs to adequately protect their business and reputation.

Similarly, commercial auto insurance is a critical component for businesses that rely on vehicles for their operations. Whether you own a single delivery van or have a fleet of trucks, having the appropriate commercial auto insurance in California is essential. This coverage not only protects your vehicles from damage, accidents, and theft but also safeguards your business against potential third-party liabilities in case of an incident involving your company vehicles.

By demystifying commercial insurance, California businesses can gain peace of mind knowing that they are adequately protected from unforeseen risks. As we delve deeper into the intricacies of restaurant insurance and commercial auto insurance, this guide will provide valuable insights and recommendations to help business owners navigate the complexities of these specialized insurance policies. Stay tuned for the next sections of this article, where we’ll explore restaurant insurance and commercial auto insurance in California in detail.

Protecting Your Restaurant with the Right Coverage

As a restaurant owner in California, it’s essential to safeguard your business with the right commercial insurance coverage. Having adequate protection ensures that you can focus on running your restaurant without worrying about the unexpected. Here’s a guide to help you navigate through the world of commercial insurance and find the coverage that suits your needs.

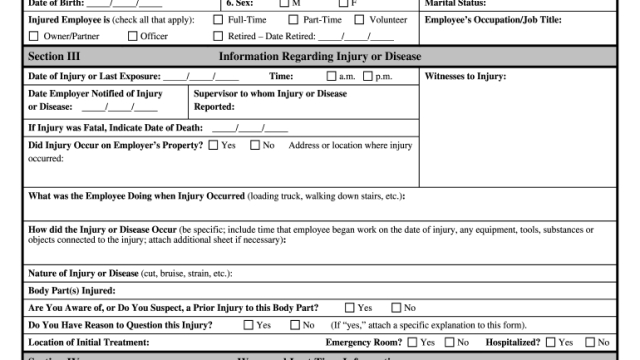

Workers Compensation Insurance in California

One key aspect of commercial insurance for restaurants in California is understanding the importance of restaurant insurance. This specific type of coverage is designed to address the unique risks that come with running a restaurant. Restaurant insurance typically includes property coverage, liability coverage, and coverage for business interruption. It can help protect your physical assets, such as the building, equipment, and inventory, as well as provide liability coverage in case of accidents or lawsuits.

Another crucial consideration is commercial auto insurance, especially if your restaurant offers delivery services. With the growing trend of food delivery, it’s crucial to have the right insurance coverage for your delivery vehicles. Commercial auto insurance provides protection in case of accidents, property damage, or bodily injury involving your business vehicles. It’s essential to ensure that your drivers and vehicles are adequately protected to maintain the safety of your customers, employees, and business reputation.

Navigating the intricacies of commercial insurance can be overwhelming, especially with specific requirements and regulations in California. However, having the right coverage gives you peace of mind, knowing that your restaurant is protected from potential risks and mishaps. By understanding the importance of restaurant insurance and commercial auto insurance, you can make informed decisions that safeguard your business’s future.

Remember, it’s crucial to consult with a licensed insurance agent who specializes in commercial insurance to ensure you have tailored coverage that meets your specific needs as a restaurant owner in California. They can guide you through the process, help you analyze your risks, and ensure that you choose the right policies to protect your business effectively. With the right commercial insurance coverage in place, you can focus on what you do best – providing exceptional culinary experiences to your valued customers.

Securing Your Business on the Road

When it comes to running a business in California, one of the key aspects to consider is transportation. Whether you own a restaurant, a delivery service, or any other business that requires a vehicle, commercial auto insurance is essential for safeguarding your operations on the road. This guide will help you understand the importance of commercial auto insurance in California and how it can protect your business.

As a business owner, you rely on your vehicles to keep your operations running smoothly. However, accidents happen, and having the right insurance coverage can make all the difference. Commercial auto insurance in California provides financial protection in the event of accidents, damage, or theft involving your business vehicles. It not only covers your vehicles but also provides liability coverage for injuries or property damage caused by your vehicles while conducting business.

Having commercial auto insurance helps mitigate the financial risk associated with accidents on the road. Without proper coverage, you could face significant expenses, including repair costs, medical bills, and potential legal liabilities. By investing in commercial auto insurance, you can protect your business assets and ensure that any unforeseen circumstances won’t disrupt your operations or put your business at risk.

Navigating the world of insurance policies can be complex, but with a comprehensive guide specific to California businesses, you can make informed decisions. Understanding the unique requirements and regulations for commercial auto insurance in California ensures that you choose the appropriate coverage for your business needs. With the right coverage, you can have peace of mind knowing that your business vehicles are protected, and potential risks are minimized.

In conclusion, securing your business on the road is vital for uninterrupted operations and protection against liabilities. By obtaining commercial auto insurance in California, you can shield your business from unexpected costs and ensure the continuity of your operations. Safeguarding your business with this essential coverage provides peace of mind, allows you to focus on what you do best, and ultimately contributes to the success of your business in the Golden State.